Florida offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Clean Energy in Florida

Jacksonville Electric Authority (JEA)

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Florida Government

The Capitol

400 South Monroe Street

Tallahassee, Florida 32399

(850) 717-9337

Hours: M-F 8:00am – 5:00pm

Florida Power & Light Company

700 Universe Boulevard

Juno Beach, FL 33408-0420

(888) 988-8249

Hours: M-F 8:00am – 7:00pm

Florida Energy Office

Florida Department of Agriculture and Consumer Services

Office of Energy

600 S. Calhoun St., Ste. B04

Tallahassee, FL 32399-1300

(850) 617-7470

[email protected]

Hours: M-F 8:00am – 5:00pm

Miami – South Florida Weather Bureau

11691 SW 17th Street

Miami, FL 33165

(305) 229-4522

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Solar Sales Tax Exemption | 6% of solar energy system costs | Individuals who purchased solar energy and combined heat and power (CHP) systems |

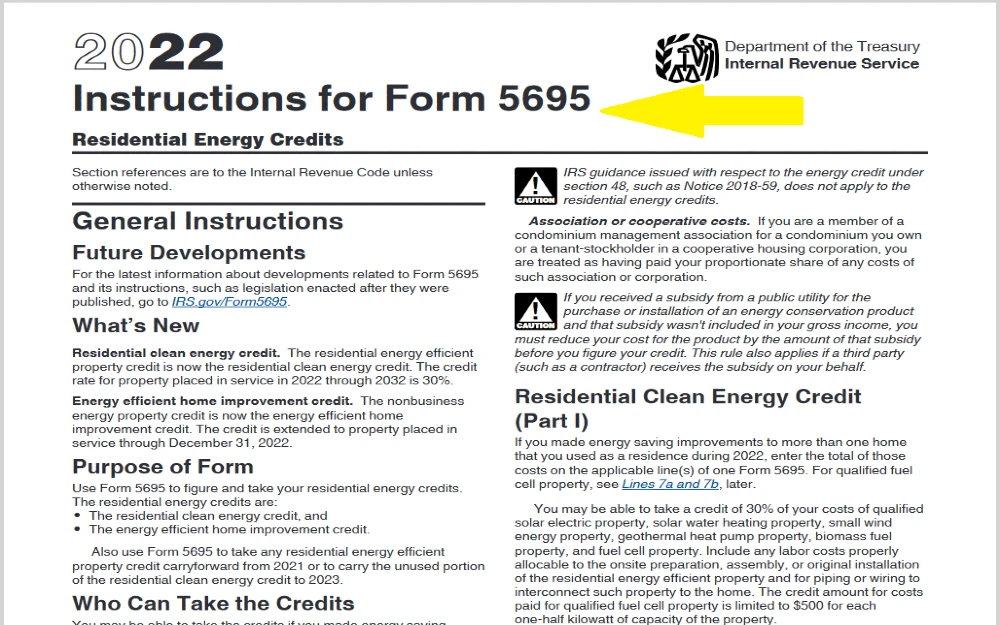

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Florida Clean Energy

My Florida Home Energy

Florida Energy Rebates

Building Efficiency

Energy Efficiency and Conservation

Transportation

Power Outage Map

Florida Department of Environmental Protection

Phone: (850) 245-2100

Email: [email protected]

Sustainable Initiatives

3900 Commonwealth Blvd MS 30

Tallahassee, FL 32399

Although Florida does not have a state-level solar tax credit incentive on par with the federal version, there are a number of local- and municipal-level energy efficiency programs and rebates that can help lower your energy costs.1

This guide provides a comprehensive overview of the Florida solar incentives you can register for when installing a home solar energy system.

Home Solar Panel Incentives in Florida

The main solar tax incentive that Floridians can take advantage of is the solar investment tax credit, which is also known as the ITC.5

Although there are some lesser-value solar tax incentives that can be used by residents to recoup funds, there are no Florida state-level solar tax incentives available equivalent to the federal ITC version.

Currently, Florida ranks 3 in the United States for solar implementation.

The United States government and Florida state government want you to switch to solar and will financially incentivize you to do so. These solar tax incentive opportunities won’t be available forever, so why not get ahead of the curve while you can?

Here is what you need to know about solar tax credits and how they work.

Solar Tax Credit: Federal Tax Credit for Solar Photovoltaics

Solar tax credits, which are also sometimes referred to as tax incentives, are simply reductions on your tax obligations based on the amount of money invested against a residential solar panel installation.

Currently, the federal tax credit for solar panels offers a 30 percent tax credit against a homeowner’s residential energy system’s investment costs.

For example, a typical Floridian might pay as much as $25,000 for a current home solar 10-kW residential system.9 This could qualify for a total tax obligation reduction of $7,500 on your next year’s tax return.10

The federal credit is officially known as the “Residential Clean Energy Credit.”

It is important to note that a solar tax credit is not a rebate or refund but a deduction, which is also known as a “tax write-off.” A tax rebate is a situation where you would get a reimbursement check against your investment costs.

However, the solar tax credit only allows you to reduce your tax obligation for the tax year in dollar-for-dollar amounts based on the percentage offered by the credit. There is no maximum financial amount limit on what you can claim against a residential solar panel installation.

Another thing to note is that you can only use the tax credit if you owe taxes.

For example, if you owe nothing in taxes, or if the tax credit is far greater in value than what you currently owe in taxes, then the solar tax credit will be carried over the next year or for several years of tax returns.

Application Process

The application process to claim a solar tax credit involves filing the applicable IRS forms along with your tax return.

So, as you file your taxes, you or your tax preparer must file a Residential Clean Energy Credit IRS form, which is also known as IRS Form 5695.11

You will also need to supply documentation from the solar panel contractor that installed the system.

Required Documentation

You will have to provide inventory costs for all purchased solar panel equipment and materials, construction permits and certification documents, bills for all contractor work, and labor.

You should also provide photo documentation of the residential solar panel system installation process.

Like all tax documentation, you don’t need to send the actual receipts to the Internal Revenue Service, but you should keep them in the event of an audit.

Residential Clean Energy Credit (ITC) Conditions and Requirements

As long as you are the homeowner applying for such, own your home and property, and wholly own the residential solar panel energy system being installed, then you qualify for the 30 percent solar investment tax credit offered by the federal government.

The federal ITC will cover up to 30 percent of the costs you incur for the needed equipment, parts, and installation expenses related to your solar panel system.

Additionally, there is no limit to the amount of money you can claim against the ITC.

As previously mentioned, to apply for this solar tax credit, all you have to do is file IRS Form 5695 along with your tax return.

Keep in mind that a solar tax credit is not a rebate, which entitles you to a reimbursement check after a period of time, or a business expense-related tax deduction. A federal solar investment tax credit allows you to reduce up to 30 percent on your tax obligation.

You won’t qualify for a refund with an ITC if you don’t owe any taxes then you don’t get a reduction in taxes via the solar credit. Any tax credit you qualify for will be applied to future tax returns.

You can only apply for the ITC once unless you move to a new property or state of residence and install a new system.

Here are 4 simple steps you can follow when claiming Federal ITC:

Step 1. Obtain Form 5695: Download IRS Form 5695, from the IRS website or obtain a copy from a tax professional.

Step 2. Complete the Form: Fill out Form 5695 to calculate your solar tax credit amount based on your solar installation expenses. You’ll include details like costs of the solar panels, inverters, and installation.

Step 3. Attach to Tax Return: Once you’ve completed Form 5695, attach it to your federal tax return, IRS Form 1040.26

Step 4. Submit: File your tax return along with the attached Form 5695 by the annual tax filing deadline, ensuring that you meet all requirements to claim your solar tax credit.

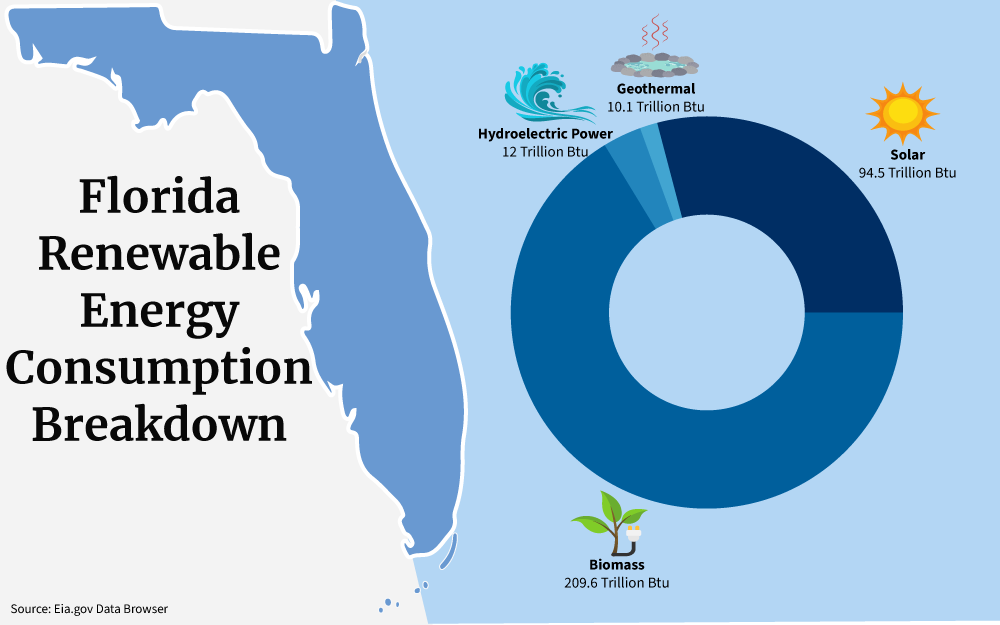

Florida’s Renewable Energy Consumption

The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy, or EERE, and the Solar Energy Technologies Office, also known as SETO, are federal energy offices that empower and finance research and initiatives that make solar panel technology more accessible and affordable to the public and business sectors.

The world is incrementally switching over to renewable energy sources in lieu of fossil fuels. The EERE states that the United States currently generates 3 percent of its total energy needs from renewable energy sources like solar.6

Many U.S. states generate up to 10 percent of their total energy needs from solar and other renewable sources.

Here are some interesting solar energy facts in Florida:

- About 6 percent of Florida’s state-wide energy generation is provided by renewable energy sources.7

- Over 70 percent of the renewable energy sources generated within the state are provided by solar energy.7

- Florida ranks seventh overall when it comes to the best states in the country when it comes to solar energy practicality and friendliness.8

Within one generation or the next, solar energy will become a much more common energy source alternative.

Solar Stimulus Program: Government Solar Panel Program Options

The state of Florida does not have a state-level solar tax credit to encourage homeowners to invest in residential solar panel installation systems.

However, Florida does offer a number of local level incentives and rebates to mitigate the costs of installing solar panels and energy efficient appliances and other devices.

While you should always use due diligence and research your local government websites and look for such opportunities, here are several solar tax credit options you can avail yourself of right now.

Florida State Sales Tax Exemption Initiative

The current state sales tax rate in Florida is 6 percent.12 However, the state sales tax obligation for qualifying homeowners who install a residential solar panel system becomes exempted after the purchase of affiliated equipment.

This solar tax credit benefit can also be taken advantage of once.

You don’t have to do anything to qualify for the solar credit based on Florida state sales tax exemption – your solar panel installation contractor must exempt the applicable state sales tax when itemizing your final bill.

For example, if your residential solar panel installation cost was $25,000, then your contractor would not apply a $1,500 state sales tax to your final bill. Even though your solar panel system contractor should know not to apply a state sales tax in this circumstance, you and your accountant should always look over such documents.

This state sales tax exemption is only applicable to solar panel systems containing PV modules and other photovoltaic-based equipment.

Property Tax Abatement for Renewable Energy Property

Installing solar panels on your residential property can increase the overall value of your home and property. Solar panels reduce carbon footprints, are eco-friendly, and are very attractive to potential homebuyers.

Depending on where you live and the value of your home, installing solar panels can increase the value of your home and property by over 4.1 percent, or the equivalent of at least $9,300.13

Still, who wants to run the risk of your property taxes increasing because you installed solar panels on your property?

The Property Tax Abatement for Renewable Energy Property is a law that prevents your property taxes from increasing due to the installation of solar panels.14 This property tax abatement incentive was ratified in Florida in July 2013 and will stay in effect as a law until December 2037.15

Your property taxes will remain unchanged for several years until they are locally assessed. How many years they will remain unchanged depends on where you live and your local property tax laws.

Florida Net Metering

In Florida, there are legal mandates declaring that every Floridian homeowner has access and opportunity to take advantage of net metering, which is also known as net energy metering, or net, relative to the homeowners’ solar energy generation.

To get net metering, all you have to do is to have a local Florida energy company inspector install smart energy meters on your property. If your residential solar panel energy system produces more energy than your property can consume, then the solar energy surplus can be transferred to the energy utility.

In return, you will be granted credits against your future energy bills. Additionally, your surplus energy credits will be equivalent to the current retail value of energy as commoditized by the utility company and not by any arbitrary value.

Boynton Beach Energy Edge Rebate Program

This is a municipal-level solar energy rebate incentive for residents of Boynton Beach, Florida only.

If you install a solar panel system or even own a fully electric vehicle, the local municipality of Boynton Beach, then you will qualify for a one-time $1,500 rebate check.16

To obtain the rebate, you will need to verify that your property is within the area limits, follow the steps outlined on the website, and fill out the paper or online form.

Dunedin Solar Energy Rebate Initiative

If you live in Dunedin, Florida, then the local government will rebate you a check of up to $2,500 depending on the size of your residential solar panel system.17

However, this rebate program has limits and conditions. You will get a rebate of 25 cents per watt of your solar panel system up to a maximum of $2,500.

This rebate is offered only on a first-come basis and until the annual funding limit is exhausted.

Dunedin residents must apply by October 1st of every year and have their residential solar panel systems inspected, permitted, and fully completed by the deadline as well.

There is no guarantee that you will qualify for the Dunedin solar energy rebate; allotted funds could become exhausted for the calendar year before you apply. So, be sure to apply early for it.

Local Florida Solar Appliance Rebate Programs

In addition to the solar system credits and rebates, local power providers also offer rebates on energy efficient appliance upgrades and replacements.

Some of the participating energy providers include the following:

Beach Cities East of Jacksonville Solar Appliance Rebate

If you live in any of the beach cities located east of Jacksonville, then you can get rebates up to $1,250 relative to any appliances or solar panel upgrades relative to your setup.18

For example, you can get a $500 solar rebate for a solar water heater or a solar-powered water heat pump.

Fort Pierce Solar Hot Water Heater Rebate

Are you a resident of Fort Pierce, Florida?

If you buy an Energy Star-approved solar water heater, then you can get a rebate of $450.19

Clay County Solar Hot Water Heater

Residents of Clay County, Florida can qualify for a $600 rebate if they install a solar hot water heater on their property.20

Homeowners can also enroll for rebates for installing solar window shade screens.

Conditions Related to the Solar Energy Tax Credit

As previously mentioned, you must apply for the federal ITC solar tax credit by filling out and adding IRS form 5695 to your tax return. You will have to include documentation like permits, inspection certifications, contractor bills, and photographs of the installation.

The previously mentioned state sales tax and property tax incentives are automatically applied when you finalize the installation of your residential solar panel system.

However, there are also several conditions that must be followed when you apply for the credit.

For one thing, you should know that these federal solar tax credit opportunities will not stay at 30 percent forever. As long as you install a residential solar panel system before 2032, then the solar tax credit rate will be 30 percent.

It will then lower to 26 percent by 2033.

By 2034, the federal solar tax credit rate will lower to 22 percent. Finally, it will become a discontinued law by 2035.

The applicant applying for the solar tax credit must own the residential property and the solar panel system being installed. The federal solar tax credit only applies to installations that were installed after 2017.

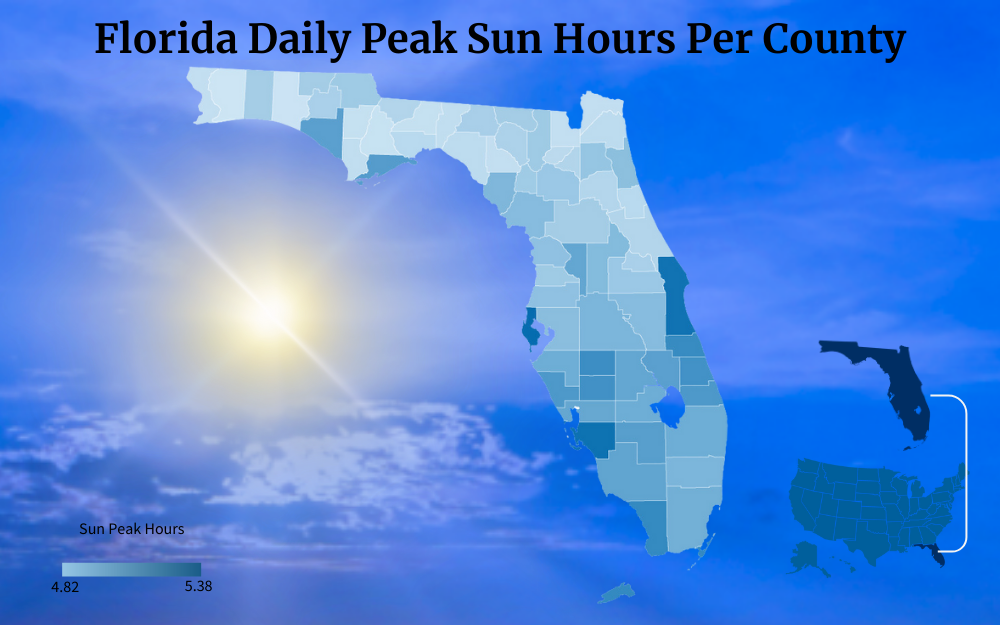

Florida Sunlight Hours Each Day By County

The state of Florida averages 230 to about 237 days of sunshine annually.2 So, taking advantage of the number of sunny days annually in Florida should help you offset the cost of investing in a residential solar panel system.

Still, you must consider which areas of the state are relatively sunnier than others. It must be noted that Florida is not even the sunniest state in the country; that honor goes to New Mexico, which was colloquially known as the Sunshine State until Florida legally adopted it as its state motto in 1970.3

Fort Myers, Florida is sunny about 73 percent of the year. If you live in Key West, the weather is sunny about 71 percent of the year.

Miami experiences sunny days about 68 percent of the year while Orlando is sunny about 65 percent of the time annually.3 Pensacola is one of the larger Florida cities that has one of the least sunny days annually with a relatively low 60 percent.4

What Materials and Parts Do You Need for Solar Panel Systems?

As previously mentioned, the cost of a 10kW solar panel system in Florida can cost as much as $25,000; but that is a conservative estimate.

How much you pay for a solar panel system will depend on numerous factors like where you live, how many sunny days your area experiences, and the energy consumption needs of your home.

Depending on where you live and the size of your solar panel system setup, your investment costs can be as high as $29,000.21

Solar panel installation is relatively cheaper than it was years ago, but it is still expensive. That is because you need specialized equipment like photovoltaic modules, rack and mounting equipment, wiring, monitoring equipment, and inverters.

Solar panels generate energy with a DC current while your electrical socket and the American electrical grid use AC current. So, solar panel inverters change the generated DC current into AC.

You may require a solar battery to store excess energy you generate for private use or to swap for credits if you use net metering.

You will probably need to get your solar panel system inspected and repaired from time to time, which also adds to overall costs.

How To Use a Solar Savings Calculator

To create a residential solar power calculator to calculate the offset costs of investing in a solar panel system, you must calculate how much money you will save monthly, annually, and over a decade on your energy bills. You also need to calculate when the system will eventually pay for itself and generate cost-free energy.

The typical Floridian household spends about $130.40 monthly on their energy bills.22 So, a Floridian household usually pays about $1,564.80 annually to pay for their energy bills.

Meanwhile, most homeowners who install a solar panel system usually save over $1,500 annually on their energy costs.23

In other words, if you get a residential solar panel system, then you could save $120 every month on your energy bill.

You don’t need to be a mathematician to see that you could save over $30,000 on your energy bill within 20 years and potentially fully pay for the cost of your solar panel system based on a simple solar energy savings calculator.

If you purchase a 10kW or greater solar panel system for your Florida home now, then you could soon start averaging $5 monthly energy bills when you offset your solar generation and watch your household consumption.

Use these metrics to develop your own solar power calculator to assess your costs and potential benefits.

Can You Make Money From Net Metering?

Yes, you can sell your surplus solar energy back to the utility company or accept credits against future bills.

If you have been selling surplus solar energy before 2024, then you will be paid the full retail rate for any energy that the utility companies charged. As long as you have your net metering installed before January 2024, then you can sell your excess solar energy at the full retail rate for the next 20 years.24

Right now, the going rate to sell back surplus solar energy to the Floridian utility companies is $0.10.8 per kWh.25

Depending on how much solar energy you generate versus how much your household uses monthly, then you could make a few bucks and up to $100 monthly via net metering, although keep in mind that these are just estimates.

Florida homeowners who apply for net metering between 2024 to 2025 will only be able to sell their solar energy surplus for 75 percent of the utility energy retail rate.24

After 2026, the selling rate will drop to 60 percent of the utility retail rate. By 2027, the selling rate for net metering consumers will drop to 50 percent of the utility retail rate.

The sooner you apply for net metering, the higher your solar bill will be for the utility companies.

It would only serve your financial interests to install solar system and apply for net metering as soon as possible. Additionally, learn as much solar panel information as possible to protect your own financial interests.

Using Photovoltaic Cells in Florida for the Solar Grid

Getting a solar panel energy system installed in Florida isn’t cheap, but the costs for home solar panels can be mitigated by rebates, tax credits, and renewable energy programs.

But, when you install them, they can help supplement the current solar farms that are operating in the state.

Moreover, there are several things you can do to hire the best solar panel installation contractors at rates that suit your needs.

Research Several Companies

Don’t just pick the first solar panel contractor that you find on Yelp; make a list of such vendors and compare their rates and services.

You may also want to get a referral from trusted friends or relatives.

Get Consultations and Verify Credentials

Contact several solar panel installation vendors and contact them for consultations. Talk about your proposed project and ask questions about their services.

Try to get contractors to visit and inspect your property as well.

Inquire about their services and find out what they would do on your property in writing. Get service quotes. Find out what you will be getting before you sign a contract.

Find out if they are licensed, certified, skilled, experienced, and insured to do the work they do. You can also research solar energy contractors on local BBB sites.

Are Free Solar Panels a Real Thing?

Although some states offer a free solar panel rebate, Florida does not. These states generally provide free solar panels for households that meet low-income criteria.

If you see any advertisements for free solar panels in FL, they may actually be deceptive ads to get you to sign a leasing or rental agreement for solar panels. The solar panels may be installed for free, but you will either pay upfront for them or in a leasing or rental plan over time.

You won’t own the solar panels, nor will you be eligible for any solar tax incentives or rebates. Also, steer clear of any offers you see for used solar panels.

The lie of solar panels is about 25-30 years, and with used ones, the maintenance plays a role in how long before you have to arrange for solar panel disposal.

Understanding how to register for Florida solar incentives is the first step in becoming energy independent and reducing your home energy costs by installing a home solar energy system.

Frequently Asked Questions About Florida Solar Incentives

How Long Do Solar Panels Last?

The life of solar panels can be as long as 30 years, depending on the manufacturer. The typical solar panel can last 25 years.

How Are Solar Panels Disposed Of After Use?

To understand what materials are used on solar panels to allow them to produce electricity, you need to understand that a solar panel module is created with glass, aluminum, plastic, copper, silicon, and some other metals. There are no dedicated solar panel disposal centers in existence yet, so you can dispose of solar panels ethically at your local recycling center.

How Much Does the Average Homeowner Pay for Electricity in Florida?

The average Floridian household pays $1,564 annually for their energy needs, but the average home with a solar panel system installed saves over $1,500 annually on their electricity bills.

References

1Butler, P. (2023, June 26). Florida Solar Panel Incentives: Rebates, Tax Credits, Financing and More. CNET. Retrieved September 3, 2023, from <https://www.cnet.com/home/energy-and-utilities/florida-solar-panel-incentives-rebates-tax-credits-financing-and-more/ >

2Son, N. T. (2023, April 22). 24 How Many Sunny Days in Florida Quick Guide. ThcsNguyenThanhSon. Retrieved September 3, 2023, from <https://thcsnguyenthanhson.edu.vn/24-how-many-sunny-days-in-florida-quick-guide/>

3Gilson, C. (2022, November 19). The other sunshine states: The 4 states that outshine Florida. Spectrum News 13. Retrieved September 3, 2023, from <https://mynews13.com/fl/orlando/weather/2020/10/13/is-florida-truly-the-sunshine-state->

4Current Results. (2023). Days of Sunshine Per Year in Florida. Current Results. Retrieved September 3, 2023, from <https://www.currentresults.com/Weather/Florida/annual-days-of-sunshine.php>

5Energy.Gov. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.Gov. Retrieved September 3, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

6Solar Energy Technologies Office. (2023). Solar Energy Technologies Office Fact Sheet. United States. Retrieved September 3, 2023, from <https://www.osti.gov/biblio/1436224 >

7EIA. (2023). Florida Profile Analysis. EIA. Retrieved September 3, 2023, from <https://www.eia.gov/state/analysis.php?sid=FL>

8Glover, E. (2023, February 24). The Best And Worst States For Solar Energy 2023. Forbes. 3. Retrieved September 3, 2023, from <https://www.forbes.com/home-improvement/solar/best-worst-states-solar/ >

9Glover, E. (2023, August 9). Florida Solar Incentives, Tax Credits, Rebates and Solar Panel Cost Guide. Forbes. Retrieved September 3, 2023, from <https://www.forbes.com/home-improvement/solar/solar-panel-pricing-incentives-florida/ >

10Rosen, A. (2023, August 1). Solar Tax Credit: What It Is and How It Works In 2023. NerdWallet. Retrieved September 3, 2023, from <https://www.nerdwallet.com/article/taxes/solar-tax-credit >

11IRS. (2023). Residential Clean Energy Credit. IRS. Retrieved September 3, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

12Florida Department of Revenue. (2023). Florida Sales and Use Tax. Florida Department of Revenue. Retrieved September 3, 2023, from <https://floridarevenue.com/taxes/taxesfees/Pages/sales_tax.aspx >

13Avery, D. (2023, April 30). How Solar Panels Can Add Thousands to Your Home’s Value. CNET. Retrieved September 3, 2023, from <https://www.cnet.com/home/energy-and-utilities/how-solar-panels-can-add-thousands-to-your-homes-value/ >

14DSIRE. (2023, May 25). Property Tax Abatement for Renewable Energy Property. DSIRE. Retrieved September 3, 2023, from <https://programs.dsireusa.org/system/program/detail/5426 >

15David, L. (2023, September 7). Florida Solar Tax Credits, Incentives and Rebates (September 2023). MarketWatch. Retrieved September 7, 2023, from <https://www.marketwatch.com/guides/home-improvement/florida-solar-incentives/>

16City of Boynton Beach. (2023). Energy Edge Rebate Program. City of Boynton Beach. Retrieved September 3, 2023, from <https://www.boynton-beach.org/284/Energy-Edge-Rebate-Program>

17Dunedin Gov. (2023). Solar Energy Grant Program. Dunedin Gov. Retrieved September 3, 2023, from <https://www.dunedingov.com/live-work-play/dunedin-green-scene/solar-energy-grant-program>

18Beaches Energy Services. (2023). Energy Rebates. Beaches Energy Services. Retrieved September 3, 2023, from <https://beachesenergy.com/my-account/energy-rebates>

19FPUA. (2023). Save Energy and Water. FPUA. Retrieved September 3, 2023, from <https://fpua.com/ways-to-save/>

20Clay Electric Cooperative. (2023). Energy Smart Rebate Program Application. Retrieved September 3, 2023, from <https://www.clayelectric.com/sites/default/files/documents/ES%20Solar%20Water%20Heater%20Application.pdf >

21Neumeister, K. (2023, August 31). Do Florida Solar Incentives Make It Affordable for Homeowners to Go Solar? EcoWatch. Retrieved September 3, 2023, from <https://www.ecowatch.com/solar/incentives/fl >

22EIA. (2023). 2021 Average Monthly Bill – Residential. EIA. Retrieved September 3, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf>

23Crail, C. (2023, July 28). How Much Do Solar Panels Save The Average Homeowner? Forbes. Retrieved September 3, 2023, from <https://www.forbes.com/home-improvement/solar/how-much-solar-panels-save/ >

24Sandoval, E. (2022, March 25). Homeowners switch to solar before Florida’s net metering bill goes into effect. Click Orlando. Retrieved September 3, 2023, from <https://www.clickorlando.com/news/local/2022/03/21/homeowners-switch-to-solar-before-floridas-net-metering-bill-goes-into-effect/>

25Everything Solar. (2023, April 11). How Much Electricity Can You Send Back To The Grid In Orlando? Everything Solar. Retrieved September 3, 2023, from <https://www.poweredbydaylight.com/blog/how-much-electricity-can-you-send-back-to-the-grid-in-orlando/>

26Internal Revenue Service. (2023). IRS Form 1040 (2022). IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

27Screenshot of IRS Instructions for Form 5695. IRS. Retrieved from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>